Let's stay in touch

Visit Our Office

Contact Us

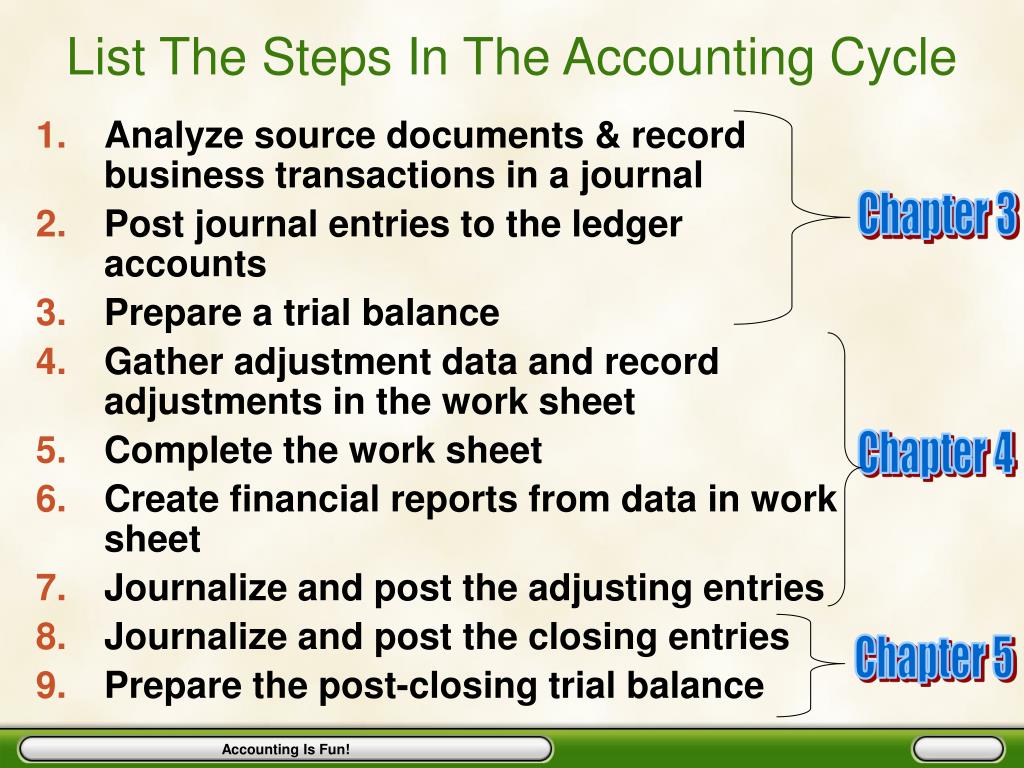

Accounting Cycle Simplified: A Step-by-Step Guide for Businesses

-

Wake Up Juice Bar > Blog > Bookkeeping > Accounting Cycle Simplified: A Step-by-Step Guide for Businesses

Accounts have to do with business operations, as well as where money is moving. The general ledger allows bookkeepers to monitor a company’s financial position. General ledger accounts are often referenced on financial statements. One of the most common to be referenced is the cash account, which tells a business how much cash is available at any time.

Step 4: Prepare the Unadjusted Trial Balance

A general journal records all financial transactions in chronological order. The general journal format includes the date, accounts affected, amounts, and a brief description of the transaction. The accounts are closed to a summary account (usually, Income Summary) and then closed further to the capital account. Again, take note that closing entries are made only for temporary accounts. Real or permanent accounts, i.e. balance sheet accounts, are not closed.

Step 5: Analyze a Worksheet / Reconcile Accounts

Subsequent steps are necessary to prepare the accounts for the next accounting period (steps 8-9). Companies might employ multiple accounting periods, but it’s crucial to note that each period solely reports transactions within that time frame. If the accounting period extends to a year, it is also termed a fiscal year. Publicly traded firms, mandated by the SEC, submit quarterly financial statements, while annual tax filings with the IRS necessitate yearly accounting periods. The accounting cycle provides a framework for recording transactions and checking them for accuracy before they make it to the financial statements. On the other hand, the budget cycle uses the financial information compiled by the accounting cycle process to forecast revenue, expenses, cash position, and more over the next accounting period.

Create a free account to unlock this Template

- You can modify it to fit your company’s business model and accounting processes.

- The financial statements are the end-products of an accounting system.

- HighRadius’s solutions not only optimize the accounting cycle but also ensure a faster, error-free close.

- Companies will have many transactions throughout the accounting cycle.

- Again, take note that closing entries are made only for temporary accounts.

It provides a solid foundation for analyzing a company’s financial health, making informed decisions based on accurate data, and maintaining a well-organized record-keeping system. By following the eight-step process, businesses are better equipped to identify errors, inefficiencies, how to fire a horrible client and areas of improvement in their financial procedures. An adjusted trial balance may be prepared after adjusting entries are made and before the financial statements are prepared. This is to test if the debits are equal to credits after adjusting entries are made.

Post transactions to the general ledger.

The accounting cycle is a systematic process followed by businesses to record, analyze, and ultimately report financial transactions. It’s an essential aspect of ensuring the accuracy and completeness of a company’s financial statements. Now that all the end of the year adjustments are made and the adjusted trial balance matches the subsidiary accounts, financial statements can be prepared.

Prepare an Unadjusted Trial Balance

The accounting cycle is started and completed within an accounting period, the time in which financial statements are prepared. However, the most common type of accounting period is the annual period. According to double-entry accounting, all transactions impact two or more subledger accounts, with equal debits and credits. The process starts with recording individual transactions and ends with creating a summary (financial statements) of the company’s financial affairs during a specific period. The accounting cycle is an eight-step process that accountants and business owners use to manage the company’s books throughout a specific accounting period, such as the fiscal year.

Throughout this section, we’ll be looking at the business events and transactions that happen to Paul’s Guitar Shop, Inc. over the course of its first year in business. Some textbooks list more steps than this, but I like to simplify them and combine as many steps as possible. You might find early on that your system needs to be tweaked to accommodate your accounting habits. He’s a co-founder of Best Writing, an all-in-one platform connecting writers with businesses.

Another perk of using accounting software is the reporting functionality that allows you to generate essential reports and analyze your company’s financial health easily. The next step is to record your financial transactions as journal entries in your accounting software or ledger. Still, businesses need to fill out expense reports to track monies paid. The accounting cycle is used by businesses and organizations to record transactions and prepare financial statements. It also helps to generate financial information to perform financial statement analysis and manage the business. The accounting cycle involves various steps, and one of the critical steps is posting transactions to the ledger.

To fully understand the accounting cycle, it’s important to have a solid understanding of the basic accounting principles. You need to know about revenue recognition (when a company can record sales revenue), the matching principle (matching expenses to revenues), and the accrual principle. Regardless of the scenario, an unadjusted trial balance displays all your credits and debits in a table. At the end of the accounting period, companies must prepare financial statements. Public entities need to comply with regulations and submit financial statements before specified deadlines. A business’s accounting period depends on several factors, including its specific reporting requirements and deadlines.

Depending on each company’s system, more or less technical automation may be utilized. Typically, bookkeeping will involve some technical support, but a bookkeeper may be required to intervene in the accounting cycle at various points. To understand the process better, let’s look at the 4 steps of a procurement cycle which can help ensure effective purchasing operations. This concept can be applied to all purchases whether it’s for inventory or fixed assets.

Recent Posts

- Chaotic Minds Chaotic Societies The Second Coming by Wb Yeats

- Communication and Professional Relationships With All People

- In Gothic texts women are either hopelessly submissive or significantly absent

- Both within The Merchants Tale by Chaucer and An Ideal Husband by Oscar Wilde the theme of power is explored with various characters attempting to

- Which One Of The Following Is An Advantage Of Essay Questions Over Recognition Questions