Let's stay in touch

Visit Our Office

Contact Us

4 4: Compute a Predetermined Overhead Rate and Apply Overhead to Production Business LibreTexts

-

Wake Up Juice Bar > Blog > Bookkeeping > 4 4: Compute a Predetermined Overhead Rate and Apply Overhead to Production Business LibreTexts

Thus the organization gets a clear idea of the expenses allocated and the expected profits during the year. The concept of predetermined overhead is based on the assumption that the overheads will remain constant, and the production value is dependent on it. To calculate their rate, the marketing agency will need to add up all of its estimated overhead costs for the upcoming year. The estimated manufacturing overhead cost applied to the job during the accounting period will be 1,450.

Alternative Approach to Closing the Manufacturing Overhead Account

Without a predetermined rate, companies do not know the costs of production until the end of the month or even later when bills arrive. For example, the electric bill for July will probably not arrive until August. If Creative Printers had used actual overhead, the company would not have determined the costs of its July work until August.

Why Do We Need to Calculate Predetermined Overhead Rate?

However, allocating more overhead costs to a job produced in the winter compared to one produced in the https://www.bookstime.com/ summer may serve no useful purpose. This option is best if you’re just starting out and don’t have any historical data to work with. Again, that means this business will incur $8 of overhead costs for every hour of activity.

How often should you calculate your predetermined overhead rate?

If a job in work in process has recorded actual machine hours of 140 for the accounting period then the predetermined overhead applied to the job is calculated as follows. If a job in work in process has recorded actual labor costs of 6,000 for the accounting period then the predetermined overhead applied to the job is calculated as follows. A predetermined overhead rate is often an annual rate used to assign or allocate indirect manufacturing costs to the goods it produces. Manufacturing overhead is allocated to products for various reasons including compliance with U.S. accounting principles and income tax regulations. The overhead rate has limitations when applying it to companies that have few overhead costs or when their costs are mostly tied to production. Also, it’s important to compare the overhead rate to companies within the same industry.

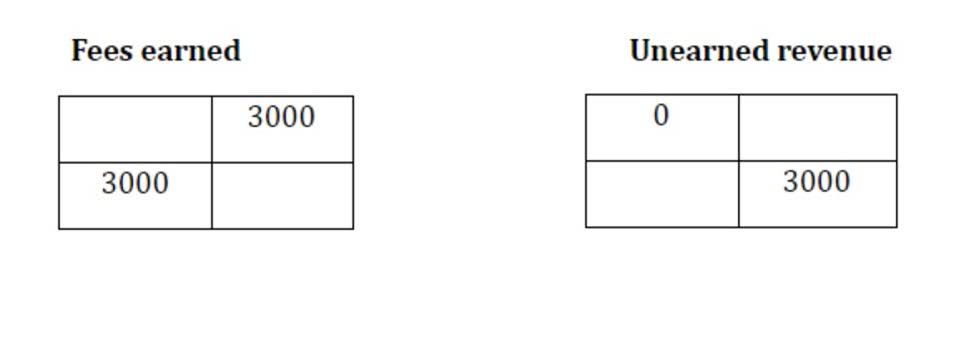

That means this business will incur $10 of overhead costs for every hour of activity. At the end of the accounting period the applied overhead is compared to the actual overhead and any difference is posted to the cost of goods sold or, if significant, to work in process. The activity base needs to https://www.facebook.com/BooksTimeInc/ be a measure which will apply the manufacturing overhead to the products on a fair and impartial basis.

Managerial Accounting

- So, if you were to measure the total direct labor cost for the week, the denominator would be the total weekly cost of direct labor for production that week.

- Using a predetermined rate, companies can assign overhead costs to production when they assign direct materials and direct labor costs.

- This means that for every hour of work the marketing agency performs, it will incur $20 in overhead costs.

- The predetermined overhead rate also allows businesses to easily calculate their profitability during the period without waiting for the actual results of its operations.

Manufacturing overhead costs include all manufacturing costs except for direct materials and direct labor. Estimating overhead costs is difficult because many costs fluctuate significantly from when the overhead allocation rate is established to when its actual application occurs during the production process. You can envision the potential problems in creating an overhead allocation rate within these circumstances. •Predetermined rates make it possible for companies to estimate job costs sooner. Using a predetermined rate, companies can assign overhead costs to production when they assign direct materials and direct labor costs.

- So, if you wanted to determine the indirect costs for a week, you would total up your weekly indirect or overhead costs.

- Despite what business gurus say online, “overhead” and “all business costs” are not synonymous.

- Predetermined overhead rates are essential to understand for ecommerce businesses as they can be used to price products or services more accurately.

- If an actual rate is computed monthly or quarterly, seasonal factors in overhead costs or in the activity base can produce fluctuations in the overhead rate.

This predetermined overhead rate can also be used to help the marketing agency estimate its margin on a project. This predetermined overhead rate can be used to help the marketing agency price its services. Overhead expenses are generally fixed costs, meaning they’re incurred whether or not a factory produces a single item predetermined factory overhead rate or a retail store sells a single product. Fixed costs would include building or office space rent, utilities, insurance, supplies, and maintenance and repair.

Ask Any Financial Question

For some companies, the difference will be very minute or there will be no difference at all between different basis while for some other companies the differences will be significant. Therefore, a company should choose the basis for its predetermined overhead rates carefully after considering all the factors. The overhead rate allocates indirect costs to the direct costs tied to production by spreading or allocating the overhead costs based on the dollar amount for direct costs, total labor hours, or even machine hours. So, if you wanted to determine the indirect costs for a week, you would total up your weekly indirect or overhead costs.