Let's stay in touch

Visit Our Office

Contact Us

Proprietary Ratio Formula, Interpretation Complete Guide

-

Wake Up Juice Bar > Blog > Bookkeeping > Proprietary Ratio Formula, Interpretation Complete Guide

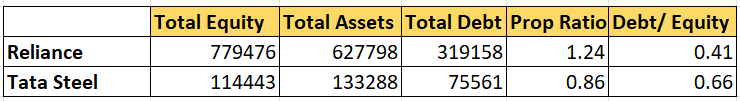

A higher transactions indicates a stronger financial foundation, making it more attractive to lenders. The higher this ratio, the more financial stability a company is considered to have.Please note that these figures are subject to change as companies release new financial data. Actual figures should be confirmed from the latest financial statements of the respective companies. Proprietary ratio shows the total assets of a company which are financed by proprietors’ funds.

- A high proprietary ratio indicates that a large part of the assets are financed by owners and contributes to the company’s sustainability.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- This metric is useful for investors, creditors, and analysts interested in evaluating a company’s financial health and risk profile.

- This ratio can be monitored on a trend line or compared with the same metric for competitors to gain a better understanding of the outcome.

Alabama Secretary of State Business Search (Step-By-Step)

The ratio is relevant for investors and creditors interested in understanding how much a company relies on equity rather than debt financing. It is also be used to compare a company’s financial structure over time or with other companies in the same industry. The proprietary ratio is a measure of a company’s financial leverage, which indicates the extent to which it is shareholders’ equity to finance its operations. This ratio is incredibly useful as it highlights the proportion of the total assets of a business that has been funded by the proprietors. Solvency ratios include various metrics such as the proprietary ratio, debt-to-equity ratio, and interest coverage ratio. For example, the debt-to-equity ratio compares the amount of debt a company has to its equity, while the proprietary ratio focuses on how much of the company’s assets are financed by shareholders’ equity.

Solvency Ratio (or Ratio of Total Liabilities to Total Assets)

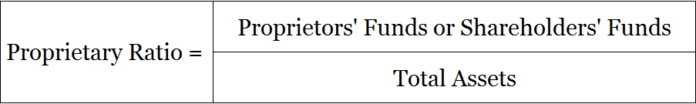

The proprietary ratio measures the amount of funds that investors have contributed towards the capital of a firm in relation to the total capital that is required by the firm to conduct operations. This ratio establishes the relationship between shareholders’ funds and total assets of the firm. It is calculated by dividing total assets (i.e., current assets and long-term assets) by tangible network.

Proprietary Ratio: Understanding Equity Ratio and Solvency Implications

It is calculated by dividing the total shareholders’ equity by the total assets of the company. It is used to assess financial stability, with a higher ratio indicating a stronger financial position. The proprietary ratio (also known as net worth ratio or equity ratio) is used to evaluate the soundness of the capital structure of a company. It should be used in conjunction with the net profit ratio and an examination of the statement of cash flows to gain a better overview of the financial circumstances of a business. These additional measures reveal the ability of a business to earn a profit and generate cash flows, respectively.

In this exploration, we will delve into the proprietary ratio, examining its significance, calculation, and implications for investors and stakeholders. In simple terms, the proprietary ratio is the ratio of shareholders’ equity to the total assets of a company. This equity ratio falls under the broader category of solvency ratios, which gauge a company’s ability to meet its long-term obligations. A high proprietary ratio shows that a significant portion of the company’s assets are financed by shareholders, not debt. The proprietary ratio is not a clear indicator of whether or not a business is properly capitalized.

Formula

This strengthens its balance sheet and makes it less vulnerable to interest rate changes or economic downturns. Companies with a high proprietary ratio are often perceived as more financially secure, which can positively influence their credit ratings and ability to secure financing at favorable terms. The proprietary ratio components are shareholders’ or proprietary funds and total assets, including goodwill, etc.

As you can see from the formula, you must take the amount of equity provided by equity shareholders and divide that by the company’s total assets. Total assets refers to a company’s total assets on its balance sheet regardless of how it was funded (through debt or equity). The main objective of using this ratio is to see how much of a company’s total assets are funded by the proprietors (or shareholders). This calculation can be done easily once you know the total value of equity and the total assets of the company. Make sure to include all equity components (equity capital, reserves) and all types of assets (fixed assets, current assets).

The P/E ratio is calculated by dividing the market price of a share by the earnings per share. Some common balance sheet ratios include the debt-to-equity ratio, the current ratio, the acid-test ratio, and the inventory turnover ratio. Using the proprietary ratio, you can measure the stability of a company’s capital structure. The Proprietary Ratio, also known as the Equity Ratio, is a crucial financial indicator as it helps assess a company’s financial stability or health. We know that shareholders’ fund is also known as proprietors’ fund or the funds contributed by the owners in a company or a business. Proprietary Ratio shows to what degree a company is financed by shareholders, while Debt Ratio shows the proportion of a company’s assets that are financed by creditors.

Keep reading as I will further break down the meaning of proprietary ratio and tell you how to calculate it. Let’s look at an example of a proprietary ratio to better understand the concept. The higher the ratio, the more the shareholders will expect to receive in a liquidation payout (and vice versa). Also, the machine required to make these bags is available at a purchase price of $5000. Now, there are two methods by which, I could not only get this machine but also manage the leverage of the company. This means that the company has financed 80% of its assets using its funds, which indicates that it is less reliant on external financing and has a strong financial position.

Recent Posts

- Chaotic Minds Chaotic Societies The Second Coming by Wb Yeats

- Communication and Professional Relationships With All People

- In Gothic texts women are either hopelessly submissive or significantly absent

- Both within The Merchants Tale by Chaucer and An Ideal Husband by Oscar Wilde the theme of power is explored with various characters attempting to

- Which One Of The Following Is An Advantage Of Essay Questions Over Recognition Questions