Let's stay in touch

Visit Our Office

Contact Us

What Does Paid in Arrears Mean?

-

Wake Up Juice Bar > Blog > Bookkeeping > What Does Paid in Arrears Mean?

In this case, payment is expected to be made after a service is provided or completed—not before. You may have come across the term „paid in arrears“ when managing your small-business accounting, but do you know what it means? Understanding arrears accounting is important so that you have an idea of how such payments are applied in https://x.com/BooksTimeInc transactions. Let’s say you run a small business that features a workforce of over 40 employees – all on hourly wages. If you’re not using arrears, you would be paying a total of 800 hours in advance. If you encounter an issue and have to close for two days, you’ll have to either adjust all of those paychecks or take them out for a future paycheck.

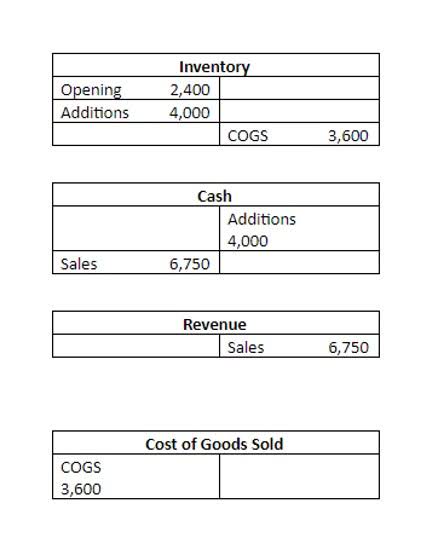

Example of Payment in Arrears

- In that case, their account is in arrears, and the supplier may choose to cut off deliveries until all payments are settled.

- Arrears, or arrearage in certain cases, can be used to describe payments in many different parts of the legal and financial industries, including the banking and credit industries, and the investment world.

- The percentage of domestic electricity customers in arrears in July was 12pc.

- Unfortunately, when COVID hit, we were forced to enact certain austerity measures and that resulted in a disagreement between the partners of how to proceed forward.

- Interest paid in arrears means that you are paying for the interest of the period that has just passed (usually the last month) in arrears.

Rent, utilities, payroll, inventory—these are just some of the expenses you’ll find yourself handling. With all of these expenses, it’s important to stay on top of billing, whether you’re paying employees or collecting payments. Interest paid in arrears means that you are paying for the interest of the period that has just passed (usually the last month) in arrears. It’s a common arrangement for mortgage and other loan repayments. In the case of mortgages, you would usually also pay the principal amount for the next month in advance, meaning you’re making both a payment in arrears and a payment in advance at the same time. The penalty relief only applies to eligible taxpayers with assessed tax under $100,000.

What Does it Mean to Bill in Arrears?

The two types of child support arrears include assigned and unassigned. If you do decide to bill in arrears, you can minimize risk by requesting a down payment or only working with customers who have a solid credit history. Your business would be in arrears since March because that’s when the payment was missed.

Arrears payments

When it comes to billing your customers, getting to know how to bill in arrears versus billing in advance is helpful before setting up your actual billing process. In the following sections, we will discuss what it means to be paid in arrears and other available options. Arrears billing is one of two ways businesses typically bill customers. In deciding how you should you bill your customers, familiarizing yourself with billing in arrears vs. billing in advance (as well as other types of billing) is a helpful step before setting up your billing process. In this article, we will go over what it means to be paid in arrears and other options you have. HOME-ARP-eligible NYCHA households may receive payments for up to 6 months of unpaid rent owed since March 2020.

What does it mean to be paid in arrears?

I believe someone who would do that should face the Death Penalty. For someone who hurt our community so gravely, the community should have the chance to speak about the appropriate sentence that person should face and the only way they can do that is through the 12 people of the jury. There are some long-term challenges regarding the grant funding that I have sought and received to rebuild the Family Violence Unit. I applied for and was appointed the District Attorney for the 34th Judicial District in December of 2022. I have been managing an office that is budgeted for 220 staff and attorneys with a combined budget of $33 million for a year and ten months now. It is true that my attorneys are overworked, but they feel good about the job that they are doing.

Have you ever been in arrears on local, state or bill in arrears federal taxes? Approved funds will go directly to NYCHA and will reduce the amount of past due rent that the household owes. Use our product selector to find the best accounting software for you. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

- There are also important resources available to get help for tax debt on IRS.gov.

- At this time there is no additional money available to NYCHA for the payment of rental arrears once the funds from the current programs are exhausted.

- Expert advice and resources for today’s accounting professionals.

- Funds for the CRA and HOME-ARP programs are limited, and households should apply as soon as possible to increase their chances of receiving assistance.

- The €250 credit will be applied to all residential electricity bills and will be paid in two €125 instalments.

Disadvantages of arrears billing:

- The disadvantage of payment in advance is that some business partners do not accept this method, for example if the invoice amounts are very high.

- The alternative to this would be “current pay”, in which employers pay their employee the day the pay week ends.

- It’s also important to comply with local, provincial, and federal labor laws when processing payroll.

- When this happens, it can be easy to fall behind on your payments and make errors on your financial records.

- For example, if you’re a plumber, you will most likely ask for payment after you’ve fixed a clogged pipe or a broken tap.

- This puts the least strain on the company’s cash flow, as payments are received immediately.

At the same time, however, it must be able to pay its own invoices, for which cash is necessary. Billing in arrears allows you to collect a customer’s payments after you’ve provided a good or service. However, since you’re collecting payment after something’s been provided, managing payments can get tricky. To manage payments in arrears, it’s important to track expenses and income. Doing so will help you manage cash flow and look at what payments are owed to you and what payments you owe to creditors. In some cases, billing or paying in arrears can result in overdue payments.

Ready To Launch Your Online Business? Understanding Payment Solutions Should Be A Top Priority

To catch up on a missed payment, you will typically have to make two payments. Paying in https://www.bookstime.com/articles/cost-of-goods-manufactured arrears has many benefits, but it’s important to make the transition as smooth as possible for you and your staff. One of the best ways to do it is by using efficient payroll software to help you manage the intricacies and complexities of paying in arrears. This type of advance payment may only represent part of the final payment due. After the client’s arrangement with the law firm ends, they’ll be billed for the total services rendered minus the retainer.

Recent Posts

- Igrovoй process v Pokerdom v udobnыh formatah

- Bet with 1Win 💰 Offers free spin 💰 2000+ slots, roulette and other

- Live Siteleri Turkey Casino 💰 Start Play With Bonus 💰 Betting & Casino Games

- Igroteka interaktivnыe slotы v sisteme sertificirovannogo kazino casino online

- Process igrы onlaйn-apparatы v sisteme čestnogo kluba azino 777